The Best Digital Experience Platforms of 2023, According to Forrester

Forrester is a leading market research company that aims to evaluate software, hardware, and services tools based on predefined criteria. Thanks to their evaluations, they have gained worldwide recognition in the field of research, and their studies serve as a reference for companies that need to know the results of the evaluated tools.

In the last quarter of 2023, Forrester conducted an evaluation that included 24 criteria for providers of digital experience platforms (DXP), identifying, researching, analyzing, and rating the most important ones. This report reveals the capabilities of the evaluated providers and helps technology companies choose the right provider for their needs.

What are Digital Experience Platforms?

Digital Experience Platforms (DXP) are a comprehensive set of technologies that enable companies to create, manage, and optimize consistent and personalized digital experiences across all touchpoints with customers, employees, and stakeholders.

A DXP connects different areas of a company, including marketing, sales, customer service, and operations. DXPs facilitate seamless collaboration and informed decision-making throughout the organization by providing collaborative tools, integrated workflows, and real-time data access. Additionally, DXPs are crucial in connecting with customers and partners.

Most DXP platforms use Artificial Intelligence (AI), which allows them to automatically collect information from all touchpoints and perform actions that engage potential customers, prompting them to respond.

Digital Experience Platforms are essential for companies seeking to deliver exceptional and consistent user experiences in an increasingly complex and competitive digital environment.

Summary of Forrester's Evaluation

The purpose of this evaluation was to invite customers to review product evaluations and examine the considerations of the assessed criteria.

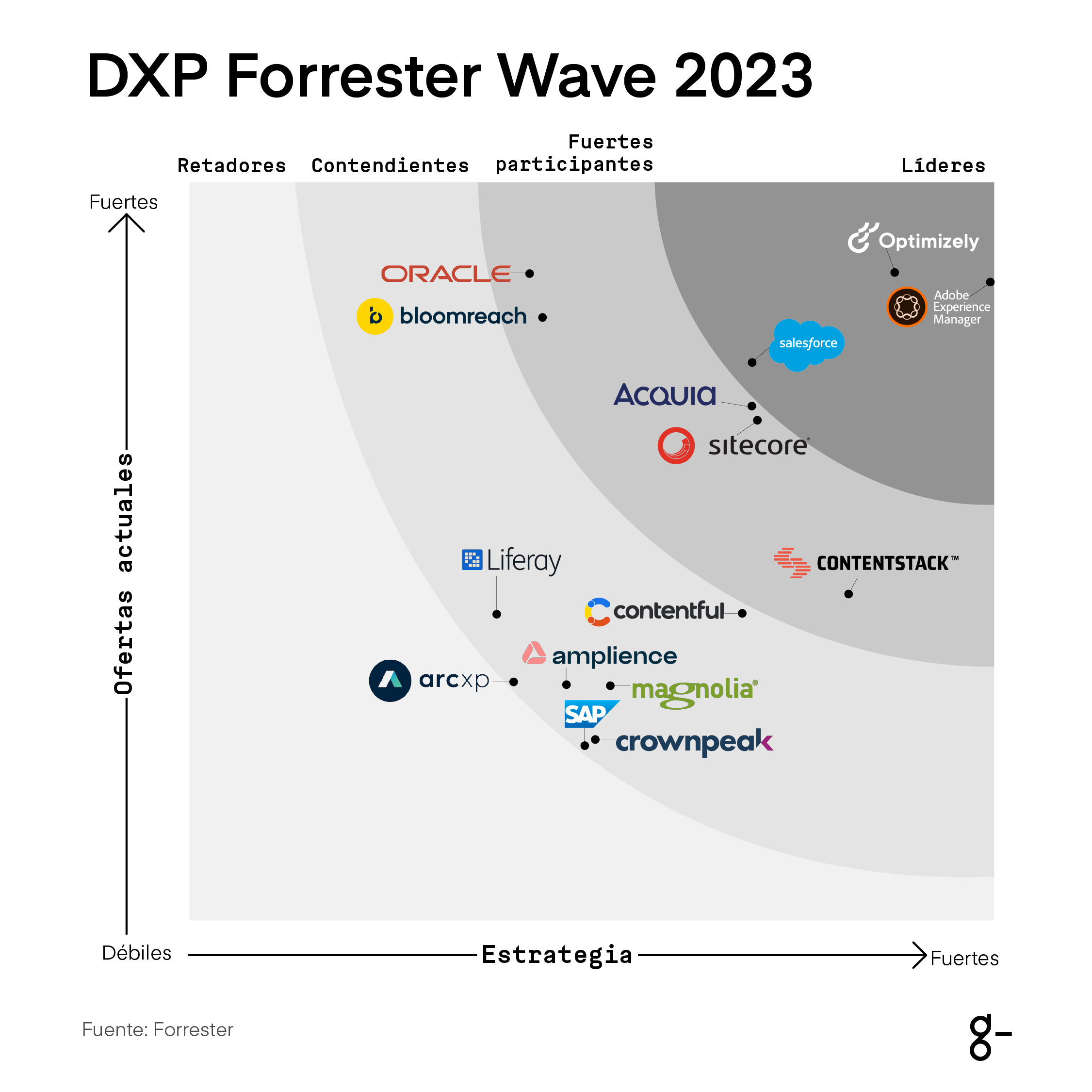

The evaluation was divided into three categories: leaders, strong performers,contenders to become market leaders

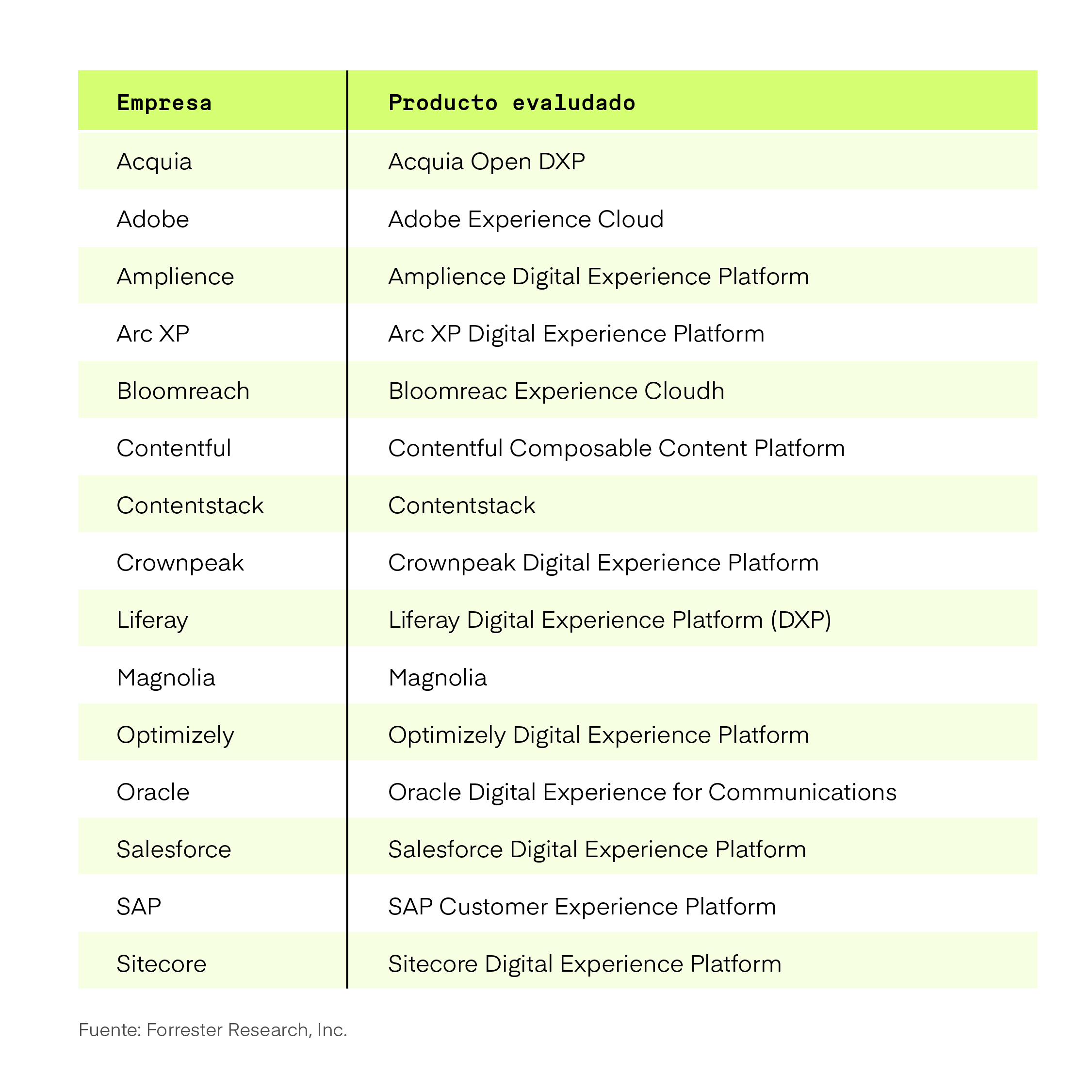

Fifteen of the top market providers were evaluated, noting that they do not represent all existing providers.

Methodology

For this evaluation, Forrester grouped its assessment criteria into three high-level categories:

Current Offering: This indicates the strength of the providers' current offerings. The criteria considered include experience experimentation, customer data, AI/ML capabilities, development tools, extensibility and integration, and application architecture.

Strategy: The results show the strength of the providers' strategies. This category evaluated vision, innovation, roadmap, partner ecosystem, and adoption.

Market Presence: Scores reflect the revenue and number of customers for each provider.

The criteria that providers needed to meet to be included in the evaluation were:

Architectural Approach for Experience Delivery: Providers must offer an API and integration frameworks. The integration strategy should be supported by a marketplace of connectors, applications, and third-party plugins.

Software for Creating, Orchestrating, and Optimizing Digital Experiences: Providers must offer well-integrated capabilities, whether proprietary or third-party, including content, customer data, transactions, analytics, and automation. These capabilities allow professionals to manage customer engagement with their digital or third-party channels.

Business Relevance and Track Record: Customer and partner feedback confirms that the products are part of enterprise architecture.

Brand Recognition Among Forrester Clients: The evaluated providers were mentioned in client inquiries, consulting projects, and Forrester studies.

The analysis revealed the following strengths and weaknesses of individual providers:

Leaders

Adobe

Adobe is known for driving some of the largest enterprise digital transformations. It has a solid vision of empowering marketing professionals with cloud-scale data that drives experience-based growth.

Adobe innovates by supporting use cases such as campaign planning registration, which can utilize personalized content variations created by Sensei genAI, optimized with a new content performance application and a new mix modeler for optimized budgeting and planning activities.

Adobe excels in most current offering criteria, especially in AI/ML, customer data, and journey orchestration. Adobe is ideal for large enterprises with complex customer data strategies that engage prospects and customers through content and interactive experiences across multiple industries.

Optimizely

Optimizely offers a portfolio of integrated SaaS applications built around a PaaS core. It is known for its ambitious consolidation and rebranding under the ownership of Insight Venture Partners.

Optimizely provides robust services and support offerings that enable digital businesses to get multiple parts for their composed DXP that work directly due to its (mutable) architecture. It focuses on AI-powered content creation workflows in strategic partnership with Azure and Google Cloud.

Optimizely excels in experience experimentation, AI/ML, and content. Optimizely is ideal for upper mid-sized content-centric companies driven by experiments and looking for productivity for marketing professionals and flexibility for developers not starting from scratch.

Salesforce

Salesforce bets big on an AI vision but leaves enterprise content to partners. It is known as a tech giant with a human touch, democratizing everything related to customer relationship management.

Salesforce has a strong partner ecosystem that offers customers a wide range of industry expertise and leading software on AppExchange. It firmly focuses on genAI, allowing its customers to use their own CRM to deliver secure and exclusive brand experiences.

Salesforce excels in AI/ML, campaign management, and tools for professionals. Salesforce Experience Cloud is ideal for existing Salesforce CRM customers who have bought into its complete portfolio vision. Salesforce declined to participate in the full Forrester Wave evaluation process.

Strong Performers

Oracle

Oracle is known for its presence, influence, and focus on cloud enterprise applications, providing a full-stack approach from infrastructure to industry applications.

It has a cloud-native platform with shared capabilities used to build its individual applications and industry solutions. Oracle spent years refactoring its acquisitions into modular components that now provide functions across its application suite, giving it a significant business advantage while offering partners the opportunity to build IP to extend applications.

Oracle excels in customer data, customer analytics, and developer tools. It is best suited for large-scale, high-complexity industrial applications to engage enterprise customers.

Bloomreach

Bloomreach has strong search and journey orchestration capabilities but lacks central commerce. It is known for its singular focus on digital experiences in enterprise content and commerce.

Bloomreach aims to build a portfolio of MACH-certified applications, connected through customer and product data that feed a set of AI-enhanced functions. It plans to use its treasure trove of customer and product data to create an AI-powered interactive shopping assistant.

Bloomreach excels in journey orchestration, search, and AI/ML. It is best suited for eCommerce sites with large catalogs.

Acquia

Acquia creates an optimal experience for both marketing professionals and developers, recognizing the importance of both roles in the digital ecosystem but lacks native commerce. It is known for its open-source approach in a comprehensive portfolio of digital experience applications for medium to large enterprises.

Acquia has a strong community of agencies building solutions with its expanding portfolio and application add-ons. Acquia plans more genAI-powered content creation tools, including a chat UX that will drive greater integration across its portfolio applications.

Acquia excels in content, professional tools, and developer tools. It is best suited for regulated industries with large volumes of content that need governance.

Sitecore

Sitecore is known for acquiring a modern portfolio to empower digital teams in the cloud era and is strongly committed to helping customers transition to a composable portfolio.

Its digital commerce capability is highly rated in this evaluation due to its ability to adapt to a wide variety of business models, from simple retail to franchise operations and B2B marketplaces.

Sitecore excels in digital commerce and experience frontend. It is best suited for financial services and industrial manufacturing firms with complex content and commerce experiences.

Contentstack

Contentstack is known for being one of the three co-founders of The MACH Alliance. It has a solid vision of what the "new backbone" of a composed digital experience platform needs to contain and what it should not have.

Contentstack's vision acknowledges that a company's digital strategy will evolve over time, creating demand for new applications. Providing the "backbone" means that Contentstack retains its place in your stack despite changes in digital appendages.

Contentstack excels in AI/ML and relatively good content support. It is best suited for companies committed to designing their DXP for a differentiated digital strategy.

Contenders

Contentful

Contentful offers cloud content and extensibility, though it favors developers over marketers. It is known for its headless, cloud-native content approach.

Designed for developers, its robust application framework allows partners to build connectors that integrate with the native interface used by marketing profiles.

Contentful has good content support and AI/ML capabilities. It is best suited for companies building digital products.

Magnolia

Magnolia has a vision of composable but lacks a cloud-native architecture. It is known for its long-standing strategy as the core of an enterprise's composed digital experience platform.

Magnolia has a strong ecosystem of system integrator (SI) partners who have built industrial applications on its core for years, using its connector framework. It remains focused on its mission of pragmatic and incremental advancements that align with its well-established customer profile.

Magnolia offers good content support, extensibility, and integration. It is best suited for conventional enterprises building content experiences across various industries with a preference for platform-as-a-service (PaaS).

Amplience

Amplience has good content but is still in the early stages of its pivot towards genAI for retail. It is known for its focus on enabling digital teams in consumer apparel brands.

Built as a headless, cloud-native CMS, Amplience aims to increasingly orchestrate elements of the entire digital experience. It relies on partners to provide many other parts of an enterprise DXP.

Amplience has good content and a solid application architecture. It is best suited for consumer product brands with flagship eCommerce sites.

Liferay

Liferay has good analytics and frontend but is late to adopt cloud-native architecture. It is known for its long history as a Java portal server, and more recently for steps taken to adopt a modern cloud application architecture.

Its new design system decouples content from presentation. Clients can use the design system as is or style and extend it to fit their brand.

Liferay has solid content and customer analytics. It is best suited for medium-sized businesses or divisions of large enterprises with a diverse set of use cases in B2C, B2B, and business-to-employee (B2E) looking for a single vendor to provide most of their digital capabilities.

Crownpeak

Crownpeak has good cloud commerce search, but its AI is still fragmented. It is known for launching the first SaaS CMS.

Crownpeak aims to build a platform that provides shared capabilities to its current and future applications, harmonizing them with AI-driven features.

Crownpeak has good experience experimentation (white-labeled from Dynamic Yield) and search (from its acquisition of Attraqt). It is best suited for rapid time-to-value for business units of large enterprises engaging enterprise customers in regulated industries.

SAP

SAP has some good applications, but the fate of its content and commerce is still uncertain. It is known for providing end-to-end workflow solutions, from customer engagement to operations and fulfillment.

SAP has good services and support offerings, which it continues to tactically integrate into its portfolio. Its capabilities are spread across acquired applications, each at a different stage of cloud maturity.

SAP excels in journey orchestration and campaign management. It is best suited for enterprises using S/4HANA to run end-to-end workflows between customer engagement and operations.

Arc XP

Arc XP has the content and architecture to help newsrooms scale, though it lacks AI. It is known for emerging from the Washington Post under the ownership of Amazon founder Jeff Bezos.

Arc XP focuses on the needs of news publishers and broadcasters in the era of vast and fast-moving news cycles. It is built entirely on Amazon Web Services (AWS) architecture, leveraging everything a cloud-native application architecture can offer.

Arc XP has a solid application architecture. It is best suited for large-scale news publishers with extensive editorial and newsroom teams.

Publication of the Evaluation

The complete evaluation results were published online in a file that includes detailed product evaluations and rankings. These scores and analyses serve as a reference point for companies to verify if what the providers offer meets their needs.

You can find it on their website: https://www.forrester.com/report/the-forrester-wave-tm-digital-experience-platforms-q4-2023/RES178451

Conclusion

Digital Experience Platform (DXP) providers are promising new applications harmonized with generative artificial intelligence (GenAI) that enhance the brand's voice at scale across all touchpoints. The key to success in the intelligent century is a platform architecture that uses data to gain insights, learn from customer interactions, and evolve experiences over time.

The study's providers offer portfolios of composable applications that work best together and utilize common capabilities from their underlying platforms.

In conclusion, the choice of provider will depend on several factors, such as the company's needs, size, industry, and existing technology.